5 Red Flags OC Home Buyers Should Watch Out for During a Walkthrough

5 Red Flags OC Home Buyers Should Watch Out for During a Walkthrough

Blog Article

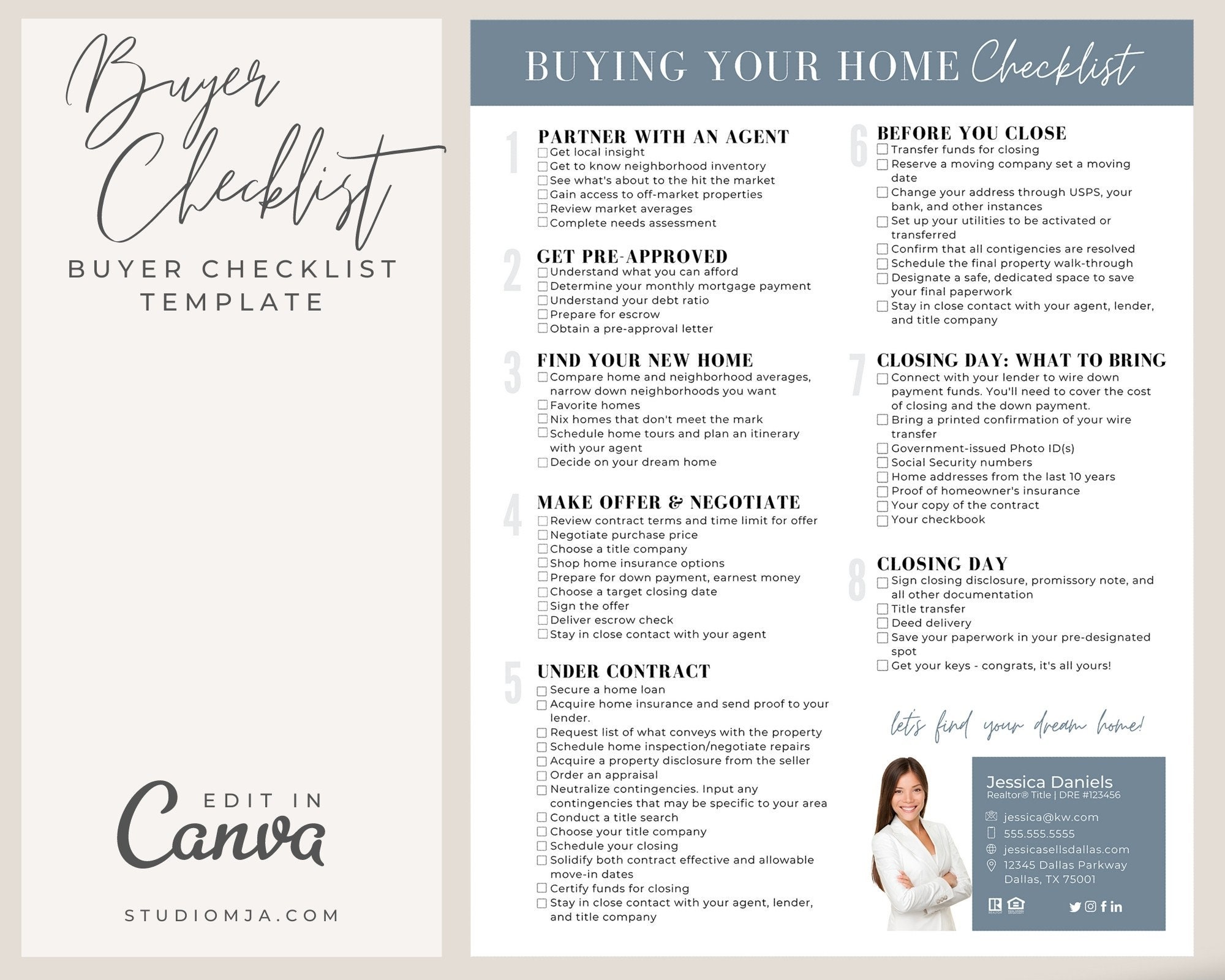

Essential Tips That Every Home Purchasers Must Know Before Buying

When you're considering purchasing a home, there are numerous crucial elements to consider that can make the process smoother and extra successful. From setting a practical budget to understanding your must-haves, each action plays an important duty in your trip. It is very important to be well-prepared and educated, especially when it pertains to negotiations and assessments. So, where should you begin to ensure you're making the most effective decision possible?

Identify Your Spending Plan and Stay With It

Prior to diving right into the home-buying procedure, it's essential to determine your spending plan and stick to it. Do not neglect to factor in extra prices like building taxes, insurance coverage, and maintenance, which can include up promptly.

When you have actually established your budget plan, it's vital to stick to it. Keep in mind, remaining within your spending plan not only makes the acquiring process smoother but likewise assures you have peace of mind as soon as you move in.

Research Your Preferred Neighborhoods

As you start your home-buying trip, researching your wanted communities can significantly influence your decision. Begin by checking out neighborhood amenities like schools, parks, food store, and public transport. These factors can improve your lifestyle and add value to your investment.

Following, take into consideration safety and security. Evaluation criminal activity data and speak with locals to obtain a feeling for the location. It's also important to check the neighborhood's future advancement plans; upcoming jobs can impact building values.

Don't forget to evaluate the neighborhood ambiance. Hang out seeing at various times of day to see if it fits your lifestyle.

Finally, take a look at the housing market trends in the location. Recognizing rate changes can assist you make educated choices. By extensively investigating your preferred neighborhoods, you'll discover a home that really meets your demands and aligns with your lasting objectives.

Get Pre-Approved for a Home Mortgage

Obtaining pre-approved for a home mortgage is a necessary step in your home-buying trip because it provides you a clear understanding of your budget plan and enhances your setting when making an offer. This process entails a loan provider examining your monetary circumstance, including your credit rating, revenue, and financial obligations (OC Home Buyers). When authorized, you'll get a pre-approval letter showing just how much you can obtain, which shows vendors you're a major buyer

Prior to you begin buying homes, collect essential records like pay stubs, income tax return, and financial institution declarations to accelerate the pre-approval procedure. Bear in mind that pre-approval isn't the very same as pre-qualification-- it's a much more detailed assessment that carries more weight.

Additionally, be mindful that your economic circumstance needs to continue to be steady throughout this time; any significant modifications could affect your authorization. With a pre-approval letter in hand, you'll really feel a lot more positive and empowered as you browse the competitive real estate market.

Hire an Educated Actual Estate Agent

When you're purchasing a home, working with an experienced property representative can make all the distinction. They comprehend the neighborhood market, have strong arrangement abilities, and know just how to satisfy your details demands. With the best representative at hand, you'll really feel much more confident in your choices.

Experience in Local Market

Locating the appropriate home in a competitive market can be difficult, yet hiring a well-informed genuine estate representative can make all the distinction. An agent with experience in your regional market understands the nuances of communities, rates fads, and property values.

Furthermore, a neighborhood agent typically has established relationships with other experts, from home mortgage lending institutions to assessors, making your home-buying procedure smoother. Their knowledge with the location can likewise highlight covert treasures or caution you about possible pitfalls. Ultimately, their guidance is important in securing your desire home.

Arrangement Abilities Matter

A well-informed real estate agent knows the subtleties of the market and can assist you secure the ideal offer feasible. They understand rates techniques and can identify when a seller is motivated to discuss.

Furthermore, a seasoned agent can browse prospective challenges, like evaluation concerns or financing obstacles, while advocating for your passions. Their settlement abilities can likewise expand beyond cost, aiding you negotiate repair services or shutting expenses. By working with a capable representative, you're not simply purchasing a home; you're purchasing a smoother, a lot more successful transaction.

Comprehending Customer Needs

Comprehending your requirements as a buyer is vital for a successful home search, particularly when you employ the aid of an experienced property representative. You must start by recognizing your priorities, such as place, dimension, and budget. This clearness enables your representative to locate residential or commercial properties that absolutely match your criteria.

Interact freely concerning your way of life-- do you require closeness to schools or work? Are you searching for a family-friendly neighborhood or a vibrant urban setting?

A good agent will certainly pay attention and customize their search accordingly. Keep in mind, your representative is the original source your supporter, so sharing your must-haves and deal-breakers Recommended Reading will assist them direct you properly. This collaboration is crucial in maneuvering the complexities of the home buying procedure.

Prioritize Your Must-Haves and Bargain Breakers

To make your home search reliable, you need to determine your must-haves and offer breakers early on. Consider crucial functions that are non-negotiable, established budget restrictions, and believe regarding exactly how crucial place is to you. This clearness will certainly assist your choices and aid you locate the ideal home quicker.

Determine Key Features

As you begin your home-buying trip, prioritizing your must-haves and offer breakers can greatly simplify the decision-making process. On the various other hand, if you function from home, a specialized office area can be an offer breaker. This clarity not only assists you focus yet additionally makes it much easier to communicate your requirements to genuine estate representatives, guaranteeing you locate a home that fits your vision.

Establish Budget Limits

Analyze Place Significance

Exactly how essential is the place of your brand-new home to your way of living? When buying a home, prioritizing your must-haves and offer breakers connected to area is crucial - OC Home Buyers. Take into consideration elements like distance to function, schools, and services. Consider your everyday routine-- just how far are you ready to commute? Are you looking for a vibrant nightlife or a relaxed neighborhood?

Research regional colleges if you have youngsters or strategy to in the future. By defining these concerns, you'll make a much more enlightened choice that lines up with your way of living and assures long-term fulfillment a fantastic read with your new home.

Conduct Thorough Home Inspections

While you could be eager to settle into your brand-new home, performing complete home assessments is vital to assure you're making an audio financial investment. Begin by employing a certified assessor that recognizes what to search for. They'll check essential locations like the roofing system, foundation, plumbing, and electrical systems, helping you reveal prospective concerns that might cost you later on.

Don't think twice to participate in the examination on your own. This offers you an opportunity to ask concerns and acquire insight into the property's condition. Take note of small details also, as they can suggest bigger problems.

If the assessment discloses significant concerns, use this information to negotiate repair services or price modifications. Remember, a detailed evaluation isn't practically detecting issues; it's additionally about recognizing the home's total condition. With the appropriate approach, you'll really feel certain in your purchase choice, guaranteeing your new home satisfies your assumptions and demands.

Comprehend the Deal and Negotiation Process

Recognizing the offer and negotiation process is crucial for making an effective home purchase, specifically since it can considerably influence your investment. Start by identifying your spending plan and knowing what you agree to pay. When you discover a building you like, your realty agent will assist you craft an affordable offer based on market conditions and similar sales.

Be gotten ready for counteroffers. The vendor may not approve your initial proposition, so stay adaptable and open up to negotiations. It is very important to comprehend the terms of the deal, including contingencies like home assessments or financing.

Interact plainly with your representative to guarantee your rate of interests are protected. Keep positive, and you'll browse the process efficiently while making a sensible financial investment.

Regularly Asked Concerns

How Do I Improve My Credit Report Before Acquiring a Home?

To improve your credit report prior to getting a home, pay for existing debts, make payments in a timely manner, avoid brand-new credit history queries, and on a regular basis check your credit history report for errors you can challenge.

What Extra Prices Should I Anticipate When Buying a Home?

When acquiring a home, you'll encounter extra prices like closing charges, property tax obligations, insurance coverage, and upkeep costs. Don't neglect to budget for moving expenses and prospective remodellings to ensure a smooth transition into your brand-new home.

Can I Revoke a Bargain After Making an Offer?

Yes, you can back out after making a deal, however it often relies on the agreement terms. If you're within the inspection or backup period, you might prevent fines, so check your agreement meticulously.

How much time Does the Home Purchasing Process Generally Take?

The home getting process generally takes about 30 to 60 days after your offer is accepted. Elements like financing, evaluations, and documents can impact the timeline, so stay positive and maintain interaction open with your representative.

What Are Typical Blunders First-Time Home Buyers Make?

New home buyers often forget budgeting for added prices, skip complete inspections, rush decisions, or fail to research study areas. You've obtained ta take your time, ask inquiries, and ensure you're making a knowledgeable option.

Report this page